KEY POINTS

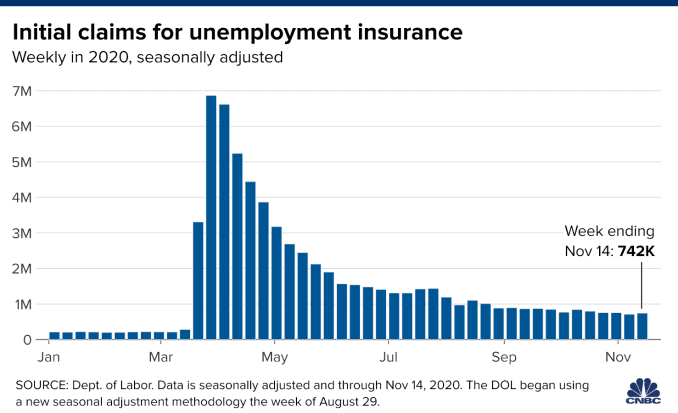

- First-time filings for unemployment benefits totaled 742,000 last week vs. the Wall Street estimate of 710,000.

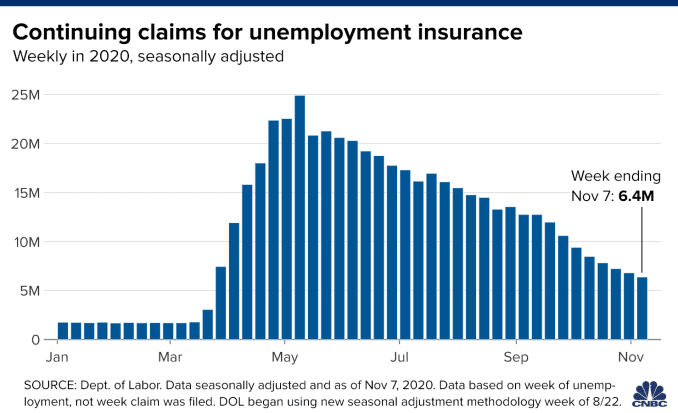

- Continuing claims fell by 429,000 to 6.37 million, a fresh pandemic-era low.

- The total of those receiving benefits declined by more than 8000,000 but remains extremely elevated.

The pace of workers filing for unemployment claims picked up last week and was a bit higher than Wall Street had been expecting.

Jobless claims totaled 742,000 for the week, the Labor Department reported Thursday, ahead of the 710,000 estimate from economists surveyed by Dow Jones.

That total also represented an acceleration from the previous week’s total of 709,000 and a continuation of the job market struggles since the coronavirus pandemic hit in early March.

The week-over-week increase was the first after four straight weeks of decline. Even with the increase for the most recent period, the four-week moving average, which smooths volatility in the numbers, decreased 13,750 to 742,00.

As has been the pattern over the past several months, there was some good news within the elevated level of filings.

Continuing claims, which trail by a week, took another substantial drop, falling 429,000 to 6.37 million, a fresh pandemic-era low. The insured unemployment rate, which is a simple calculation of those getting benefits against the total labor force, also continued to decline, falling to 4.3%.

The road ahead for the jobs market is unclear amid rising coronavirus cases. Economists worry that increased restrictions on activity could push the jobless level back up again.

The migration of workers who have lost their normal benefits onto the governments Pandemic Unemployment Assistance program also continued. Claims for the PUA program increased by 23,863 to 320,237, while the PUA emergency assistance program, data for which runs two weeks behind, increased by 233,458 to 4.38 million.

The total of those receiving benefits, which runs two weeks behind, fell by 841,245 to 20.32 million, compared to 1.48 million a year ago.

At the state level, Illinois posted a sharp decline of 20,632, according to unadjusted data. Other notable drops came from Florida (-9,865), New Jersey (-8,689) and Washington (-8,516). Massachusetts posted the largest increase at 9,303.

The total for the most recent week gets a little more market attention as it includes the survey week that the Labor Department uses for its closely watched nonfarm payrolls report. Payrolls increased by 638,000 in October while the unemployment rate fell to 6.9%.