The world in 2020 keeps “delighting” us with global risks. We have already seen a lot, but this is far from the end. Now we are waiting for, perhaps, the most challenging autumn since the bankruptcy of the legendary bank Lehman Brothers in September 2008. That time the World Financial Crisis turned into an acute form, investors began to exit stocks and shift their savings into US dollars.

The current crisis dramatically differs from the previous one. Apart from the word “crisis,” these two economic events have little in common. If, in 2008, all the risks appeared due to thoughtless and risky market activity, the current crisis came from a completely different sphere and had completely different reasons, particularly deep socio-political ones.

The political picture of the world has always been an essential element of investment activity, but in 2016 it became more important than ever, and in 2020 it became incredibly significant. On November 3, the US presidential elections will be held – this is the top risk for any mid-term investor. It is profitable to keep US dollars money only if your income is in a weaker currency (ruble, the hryvnia, Turkish lira, Mexican peso, etc.). Otherwise, you would need securities, but securities that will survive the market storm before the elections. So we need diversification.

Based on this, we need stable companies and a broad set of tools. If you have much time and can afford to find 2-3 brokers, each of those gives a part of the necessary securities, there’s nothing more we can assist you with. However, if you want an all-in-one solution, then you will have to choose carefully. Let’s first decide what we need?

First, you need securities from different countries – almost any company can provide this. We need papers from the US retail and utility sector. They will provide stability even if Trump loses.

Secondly, it would be nice to have access to ETFs on high-tech securities – there are significantly fewer such companies in the market. Yet, this tool can provide profitability in the long-term, and in the event of a sharp fall in the markets, ETF losses will be much less than for NASDAQ stocks.

Thirdly, it would be nice to add bonds to our portfolio – here we have even fewer candidates. However, if we want to live up to stable times (at least a year after the US presidential election), we need conservative instruments to hide funds from inflation.

The most famous and trustworthy bank that allows you to create a pleasant portfolio of all three types of assets is Saxo Bank. The main disadvantages, though, are complicated trading platform, high fees, and tight currency control.

You can choose from a traditional brokerage house or an investment group like Just2Trade. The number of instruments available for trading will satisfy any need. Still, for this, you will have to sacrifice time spent on communicating with managers, clarifying details, agreeing on terms of trade, and forth. If you want to be in time before the presidential elections, it is better to start now.

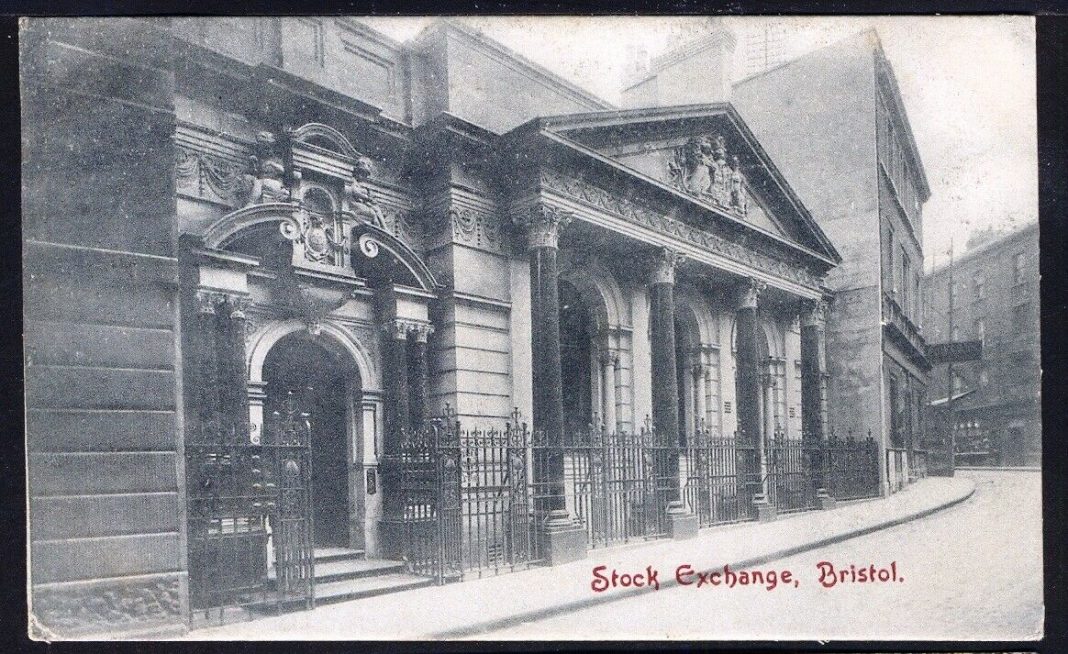

Another option is to find a newcomer with a wide range of tools. Of the cons, it is worth mentioning that there are very few of such companies in the market; lack of competition makes the commissions slightly higher than in the “classic brokerage companies” with a traditional set of tools. Besides, the majority of such companies are overseas. A bright representative of new market players is Bristol House Corporation. As for the disadvantages, it is not yet a well-known company, with a relatively short history.

However, the volume of instruments is impressive. Yet, there are many indices and cryptocurrencies available (which performed well during the period of increased risks in March-April 2020). From the pros – you can choose the account’s currency, deposit, and withdrawal quite fast; faster than in Just2Trade, but longer than in a bank.

To sum up, we need to start preparing for November right now. Getting used to the terminal, getting to know your manager, and finding “your” tools takes time.