KEY POINTS

- Corporate earnings season will continue to drive individual share price movement, with BNP Paribas, Sanofi, Intesa Sanpaolo and Thyssenkrupp all reporting before the bell on Friday.

- The MSCI ACWI, an index of the world’s 50 largest markets, rose 0.2% to 668.07 early in the European trading session, closing in on the record high of 670.82 notched around two weeks ago.

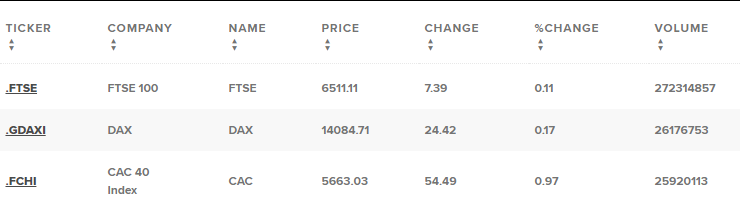

European stocks were modestly higher Friday as investors look to vaccine rollouts for hopes of normalization, while global markets flirt with record highs.

The pan-European Stoxx 600 gained 0.4% by late morning trade. Banks climbed 1.9% to lead gains while telecoms fell 0.7%.

European markets received a positive handover from Asia-Pacific. Shares broadly rose during Friday’s trade, taking their lead from Wall Street where the S&P 500 notched a record closing high on Thursday, as major U.S. indexes look to close out their strongest week since November.

Futures stateside advanced in premarket trade on Friday as investors await January’s jobs report from the Labor Department, due at 8:30 a.m. ET.

The MSCI ACWI, an index of the world’s 50 largest markets, rose 0.24% to 668.36 early in the European trading session, closing in on the record high of 670.82 notched around two weeks ago.

Johnson & Johnson announced Thursday that it had requested authorization for emergency use of its single-dose Covid-19 vaccine from the U.S. Food and Drug Administration (FDA), and will apply to the European authorities within the next few weeks.

The EU’s drug regulator said Thursday that it was assessing data on therapeutic antibody treatments for some outpatients from U.S. drugmakers Regeneron and Eli Lilly.

In corporate news, concerns are growing about a shortage of semiconductors for the automotive industry, after Ford and Stellantis announced production cuts due to the issue, while German supplier Robert Bosch and chipmaker Infineon issued warnings.

Corporate earnings season continues to drive individual share price movement, with BNP Paribas, Sanofi, Intesa Sanpaolo and Thyssenkrupp all reporting before the bell on Friday.

BNP Paribas posted a net income of 1.59 billion euros ($1.90 billion) for the fourth quarter of 2020, beating analyst expectations of 1.2 billion euros, according to Refinitiv. The French lender’s shares added 3.8%.

Beazley shares jumped more than 14% by late morning after the British insurer voiced confidence in the outlook for 2021 despite swinging to a loss in 2020.

At the bottom of the European blue chip index, Finnish engineering firm Neste fell 5.3% after its fourth-quarter earnings report.