KEY POINTS

- Last week, the U.S. 10-year yield surged to a high of 1.6% in a move that some described as a “flash” spike, but which sparked fears about stock valuations and rising inflation.

- It’s another busy day for earnings in Europe, with Thales, Lufthansa, Merck, ProSiebenSat.1 and Aviva among those reporting before the bell.

- Lufthansa posted a smaller-than-expected net loss in the fourth quarter but saw a full-year loss of 6.7 billion-euro ($8.1 billion) in 2020.

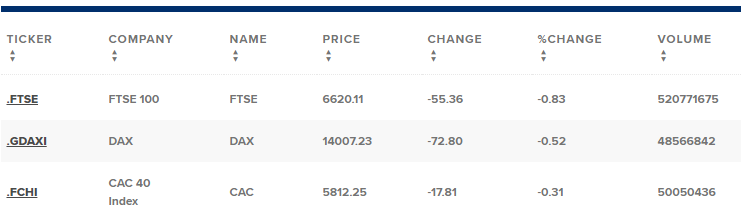

European markets mostly retreated Thursday as a rise in bond yields saw jitters return to global stocks once again.

The pan-European Stoxx 600 was down 0.4% by mid-afternoon having earlier fallen more than 1%. Basic resources dropped 3% while utilities added 1.1%.

European stocks received a weak handover from Asia-Pacific, where Japan’s Nikkei 225 and Hong Kong’s Hang Seng index dropped more than 2% as the 10-year U.S. Treasury yield rose again. Mainland Chinese stocks also slipped on the day, with the Shanghai composite down 2.05% to 3,503.49 while the Shenzhen component dropped 3.458% to 14,416.06.

The 10-year yield stabilized early in the session but began to climb again during afternoon trade in Europe, and was last seen at 1.4791%. U.S. stock futures were flat prior to the open, retracing earlier losses.

Last week, the 10-year yield surged to a high of 1.6% in a move that some described as a “flash” spike, but which sparked fears about stock valuations and rising inflation.

Tech stocks have been the major casualty of the retreat, with investors pivoting to stocks seen as having potential to benefit from an economic recovery, in the wake of Covid-19 vaccination rollouts and progress towards a U.S. fiscal stimulus package.

Investors stateside will be keeping an eye on a speech from Federal Reserve Chairman Jerome Powell later on Thursday for indications as to the direction of growth and inflation.

On the data front, UK construction industry activity climbed by more than expected in February. The IHS Markit/CIPS UK construction PMI (purchasing managers’ index) rose to 53.3 from 49.2 in January, returning to expansion and outstripping expectations.

Euro zone retail spending fell sharply in January, official figures revealed Thursday, down 5.9% month-on-month and falling significantly short of average forecasts for a 1.1% contraction.

It’s another busy day for earnings in Europe, which promises to be a key driver of individual share price action. Thales, Lufthansa, Merck, ProSiebenSat.1 and Aviva were among those reporting before the bell.

Lufthansa posted a smaller-than-expected net loss in the fourth quarter but saw a full-year loss of 6.7 billion-euro ($8.1 billion) in 2020. The airline warned that it will struggle to profit from flights before the end of 2021 as the pandemic continues to hammer air travel demand.

At the top of the Stoxx 600, Belgian pharmaceutical company Galapagos climbed more than 5% after promising interim results from an ongoing anti-inflammatory drug study.

Aviva exceeded company expectations to post flat 2020 operating profit of £3.2 billion ($4.5 billion) and sold out of its remaining businesses in Italy to focus on core markets, sending the British insurer’s shares 2.8% higher.

Anglo-Australian mining titan Rio Tinto dropped 5.9%, after chairman Simon Thompson announced he would step down over the company’s destruction of a 46,000-year-old indigenous site in Western Australia.

ProSiebenSat.1 shares fell 6.6% after the company projected single-digit revenue growth in 2021 despite a strong fourth quarter, while Swedish software company Sinch fell 6.8% to the bottom of the European index.