Global equity funds continued to witness inflows in the week ended March 3, buoyed by hopes of a faster economic recovery from the pandemic, also supported by the recent retreat in U.S Treasury yields.

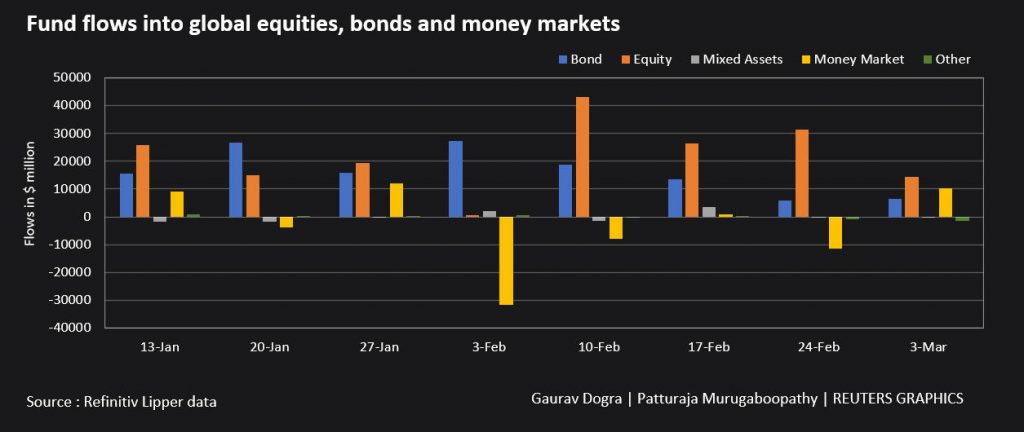

Investors purchased $17.15 billion worth of global equity funds in the week, which was the ninth consecutive inflow, data from Refinitiv Lipper showed.

Also, they bought $6.8 billion in bond funds and $11 billion in money market funds, the data showed.

Graphic: Fund flows into global equities, bonds and money markets –

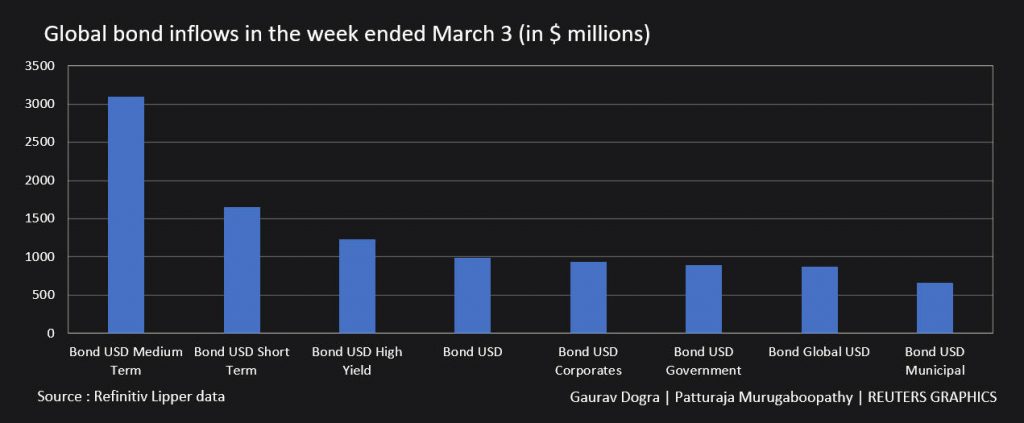

Graphic: Global bond inflows in the week ended March 3 –

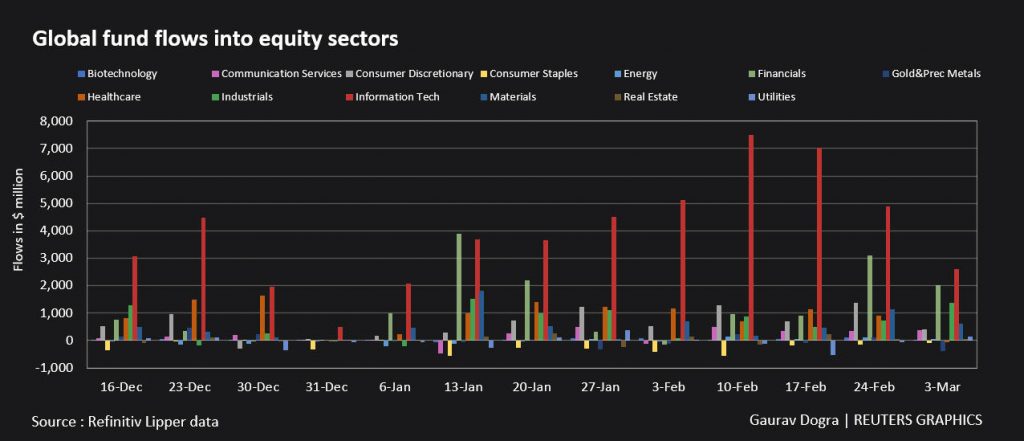

Among equities funds, tech funds had an inflow $2.7 billion, the lowest in eight weeks, due to higher bond yields. Higher yields lower the present value of future cash flows of growth stocks.

On the other hand, recovery hopes helped money flows into industrial sector funds, which saw net purchases of $1.4 billion, the highest in seven weeks.

Among commodity funds, precious metal funds saw net sales of $2.2 billion, the fourth consecutive weekly outflow.

Graphic: Global fund flows into equity sectors –

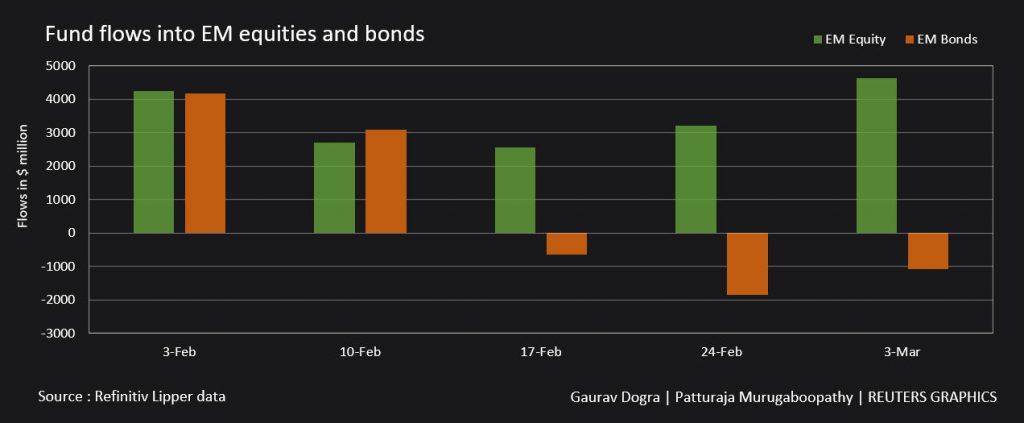

An analysis of 23,637 emerging market funds showed equity funds had an inflow of $4.8 billion, the biggest in five weeks, thanks to the increased risk appetites.

On the other hand, emerging market bond funds witnessed net sales of $1.2 billion, marking a third consecutive week of outflow, hit by higher U.S. yields.

Graphic: Fund flows into EM equities and bonds –