Payments company Square’s announcement that it would put some $50 million, or 1% of its assets, into bitcoin has touched off speculation that more corporations might do the same.

Jack Dorsey, the Twitter CEO who also helms Square, is a longtime bitcoin bull so it wasn’t a huge surprise that his company would put some of its corporate liquidity into the cryptocurrency. He’s following the path of MicroStrategy CEO Michael Saylor, who has invested at least $425 million of the company’s assets in bitcoin.

None other than Changpeng “CZ” Zhao, CEO of Binance, the world’s largest cryptocurrency exchange, tweeted a question: “Who’s going to be the 3rd public company to hold #bitcoin in treasury?” Guesses included Twitter, Tesla, Apple, Warren Buffett’s Berkshire Hathaway, even the burger chain Wendy’s.

“It’s a bit surreal to see gigantic corporate entities now going knee-deep in bitcoin,” Mati Greenspan, founder of the foreign-exchange and cryptocurrency analysis firm Quantum Economics, wrote to subscribers on Thursday.

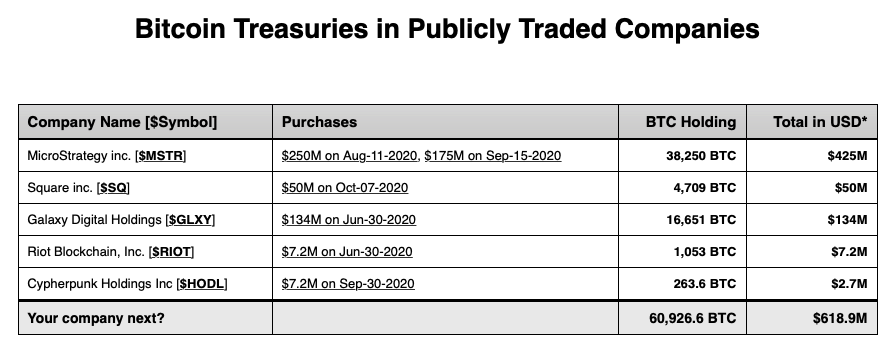

One clever, enterprising soul even ginned up a spreadsheet to keep track of the corporate purchases and published it as a new website, bitcointreasuries.org:

Companies in the Standard & Poor’s 500 Index of large U.S. stocks have a combined $2.3 trillion in cash and short-term investments. So a 1% across-the-board allocation to bitcoin would amount to $23 billion of purchases. That’s just over 10% of bitcoin’s total market capitalization, currently about $200 billion.

A big bullish investment thesis for bitcoin is that large institutional investors are on the verge of diving into cryptocurrencies as an asset class, led by money managers like Fidelity Investments that have embraced the new technology and digital-asset markets.

Now it seems like corporate purchases might add to that buying pressure.

Dorsey tweeted out a “whitepaper” to his 4.7 million followers explaining just how Square had come to buy its bitcoin — noting that the transparency was intended “so others can do the same.”

“To maintain transaction privacy and price slippage on execution, treasury purchased the bitcoin over-the-counter with a bitcoin liquidity provider that we currently use as part of Cash App’s bitcoin trading product,” according to the whitepaper. “We negotiated a spread on top of a public bitcoin index and executed trades using a time-weighted average price (TWAP) over a predetermined 24-hour period with low expected price volatility and high market liquidity, in order to reduce risks associated with cost and pricing.”

Got that, corporate treasurers?

Bitcoin has jumped over 3% in the past 24 hours to set a three-week high above $11,000.

- The move has confirmed a contracting triangle breakout on the daily chart.

- Even so, some analysts remain cautious and want to see the cryptocurrency take out resistance at $11,200 before calling a bullish revival.

- “We consider the breakout of the Sept. 19 high of $11,200 to be a more significant catalyst for further upside,” Lennard Neo, head of research at Stack Funds, told CoinDesk. He added that the price range of $10,000 to $11,200 may hold until more clarity surfaces going into November U.S. elections.

- The rise comes a day after payments company Square announced that it had put 1% of its total assets into the largest cryptocurrency by market cap.

- Prices hit $11,023 at 11:05 UTC – the highest since Sept. 20, according to CoinDesk’s Bitcoin Price Index.

- The rally to $11,000 marked an upside break from the past two week’s range of about $10,500 and $10,800.