The safe-haven Japanese yen rose against the dollar, reversing losses the past several days as risk sentiment gained with growing recovery hopes.

“There has been this unwinding of negativity since the last week of May, particularly negative U.S.-China bets,” said Erik Bregar, head of FX strategy, at Exchange Bank of Canada in Toronto.

Commodity currencies such as the Australian, New Zealand, and Canadian dollars were well-bid. The New Zealand dollar, for one, climbed to its highest in four months after New Zealand said it had stopped transmission of the coronavirus within the country.

New Zealand Prime Minister Jacinda Arden on Monday said the country would lift all virus-containment measures apart from border controls, making it one of the first countries to do so.

But as the United States and economies around the world reopen, there have been nagging doubts as to where the recovery is headed.

“The UK, for instance, plans to reopen and one of the things to consider is Brexit,” said Juan Perez, currency trader at Tempus Inc in Washington.

“Once we establish that Brexit is one of those 2019 issues that needs to be resolved, we could see the major rally in the euro come under pressure because the market may focus once again on what type of partnership Europe would have with the UK,” he added.

In afternoon trading, the dollar index dipped 0.1% to 96.641 in choppy trading, after having gained overnight.

The dollar fell sharply against the yen, down 1.1% at 108.33 . It also dropped 0.6% against Swiss franc, another safe haven, to 0.9566.

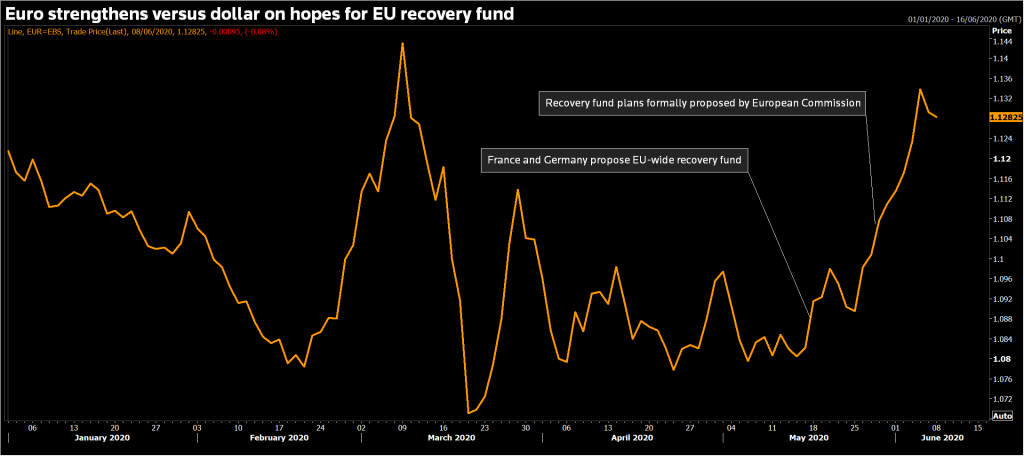

The euro was higher against the dollar despite data showing German industrial output plunged the most on record in April as the pandemic forced companies in Europe’s largest economy to scale back production.

The euro was last up 0.2% at $1.1303. It reached a three-month high of $1.1384 last week after the European Central Bank announced it was expanding its stimulus program.

The New Zealand dollar rose 0.8% versus the greenback to US$0.6560, earlier hitting a high of US$0.6564, its strongest since late January. The Australian dollar also rose 0.7% to US$0.7017, with the Canadian dollar also rising, trading 0.4% higher at C$1.3366 per U.S. dollar.

Investors are now focused on the U.S. Federal Reserve policy meeting this week. The Fed will need to balance signs that economic fallout from the pandemic is past its worst against evidence the virus itself is not yet under control.