The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus.

The new fed funds rate, used as a benchmark both for short-term lending for financial institutions and as a peg to many consumer rates, will now be targeted at 0% to 0.25% down from a previous target range of 1% to 1.25%.

Facing highly disrupted financial markets, the Fed also slashed the rate of emergency lending at the discount window for banks by 125 basis points to 0.25%, and lengthened the term of loans to 90 days.

Despite the aggressive move, the market’s initial response was negative. Dow futures pointed to a decline of some 1,000 points at the Wall Street open Monday morning.

The discount window “plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy … [and] supports the smooth flow of credit to households and businesses,” a separate Fed note said.

The discount window is part of the Fed’s function as the “lender of last resort” to the banking industry. Institutions can use the window for liquidity needs, though some are reluctant to do as it can indicate they are experiencing financial issues and thus sends a bad message.

Global coordinated action

The Fed also cut reserve requirements for thousands of banks to zero. In addition, in a global coordinated move by centrals banks, the Fed said the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank took action to enhance dollar liquidity around the world through existing dollar swap arrangements.

The banks lowered the rate on these swap line loans and extended the period for such loans. The actions by the Fed appeared to be the largest single day set of moves the bank had ever taken, mirroring in many ways its efforts during the financial crisis that were rolled out over several months. Sunday’s move includes multiple programs, rate cuts and QE, but all in a single day.

At a press conference Sunday evening following the decision, Powell said the Fed would be patient before lifting rates again.

“We will maintain the rate at this level until we’re confident that the economy has weathered recent events and is on track to achieve our maximum employment and price stability goals,” Powell said.

“That’s the test … some things have to happen before we consider … we’re going to be watching, and willing to be patient, certainly,” he added.

The quantitative easing will take the form of $500 billion of Treasurys and $200 billion of agency-backed mortgage securities. The Fed said the purchases will begin Monday with a $40 billion installment.

Cleveland Fed President Loretta Mester was the lone no vote, preferring to set rates at 0.5% to 0.75%, which would have represented a 50 basis point, of half percentage point, reduction.

The Fed added in its statement that it “is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.”

It appeared, though it was not entirely clear, that the meeting that took place will replace the regularly scheduled meeting of the Federal Open Market Committee.

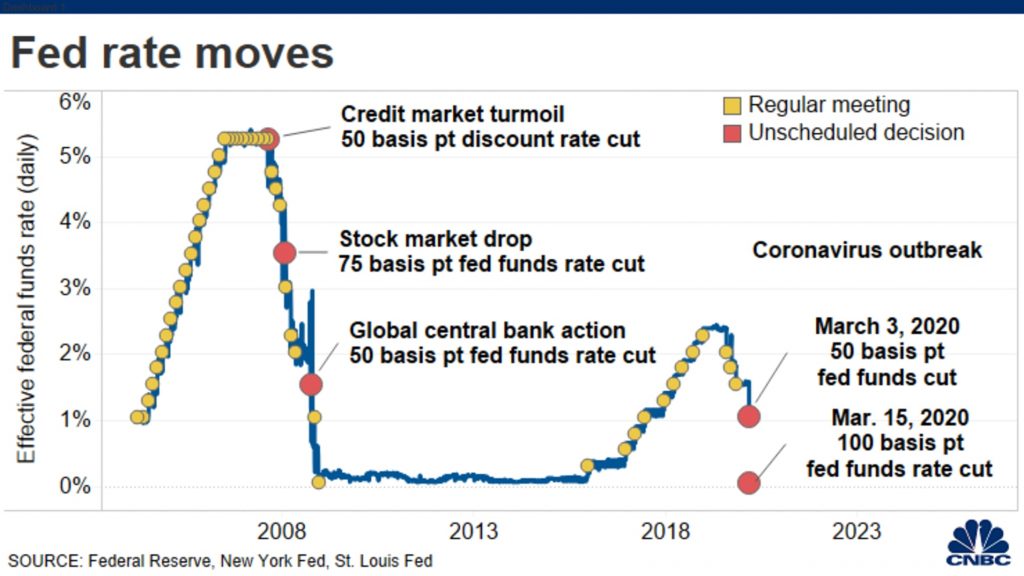

The move follows several actions by the Fed over the past two weeks in which it enacted a 50 basis point emergency rate cut and expanded the overnight credit offering, or repo, for the financial system up to $1.5 trillion.