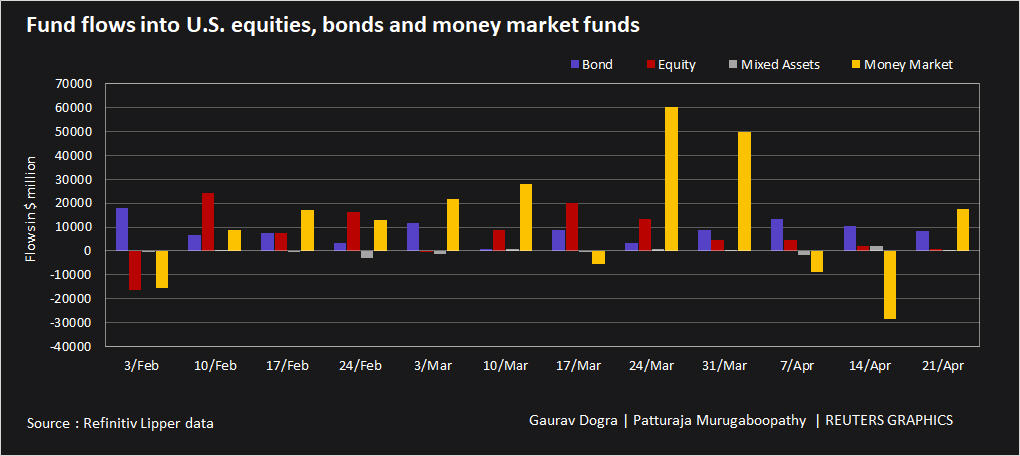

U.S. equity funds received their lowest inflows in seven weeks in the week ended April 21, pressured by rising coronavirus cases, which have cast doubts over global economic recovery.

According to Refinitiv Lipper data, U.S. equity funds took in $878 million in the week, the lowest since the week ended March 3.

For a graphic on Flows into U.S. funds:

U.S. major equity indexes, the &P 500 and Dow Jones Industrial Average have slipped from record high levels, led by a slump in travel-related shares on renewed worries over the pandemic.

Among sector funds, tech and healthcare had outflows of $732 million and $663 million respectively.

On the other hand, the financial sector had inflows of $550 million.

For a graphic on Flows into U.S. sector funds:

U.S. money market funds took in $17.6 billion, after seeing big outflows in the previous two weeks, underscoring investors’ preference for safer assets.

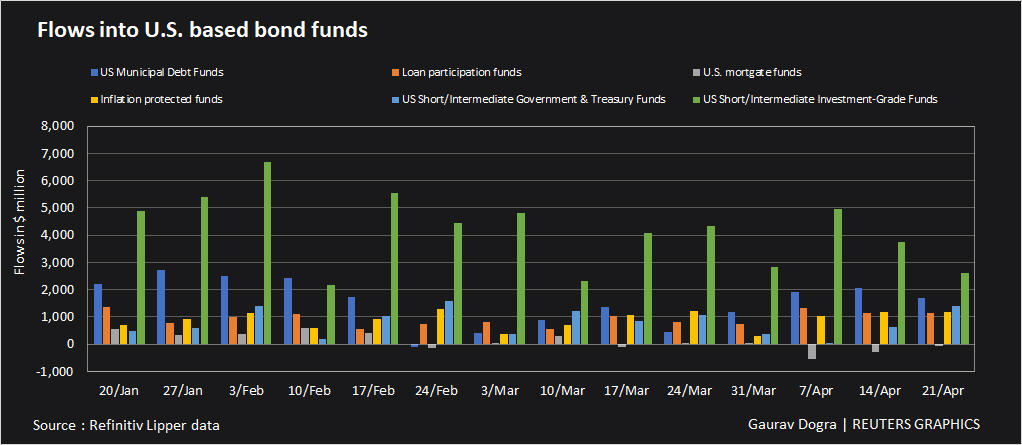

U.S. bond funds also had net purchases of $8.4 billion, resulting in a decline in U.S. Treasury yields.

For a graphic on Flows into U.S. bond funds:

U.S. taxable bond funds had $6.2 billion in inflows, while municipal bond funds had inflows of $1.7 billion.