Oil prices fell on Monday, extending last week’s losses, as increasing coronavirus cases in the United States and Europe raised worries about energy demand, while Libya’s fast growing production also weighed on prices.

Brent LCOc1 was down $1.08, or 2.6%, at $40.69 by 0934 GMT. U.S. West Texas Intermediate (WTI) dropped $1.05, or 2.6%, to $38.80. Both contracts fell almost 2.5% last week.

The United States reported its highest number yet of new coronavirus infections in two days through Saturday, while in France new cases hit a record of more than 50,000 on Sunday. Italy and Spain imposed fresh restrictions to curb the virus.

The rising number of cases “not only highlight the risks posed by immediate transport restrictions, but also dampen long-term demand expectations,” said Commerzbank analyst Eugen Weinberg.

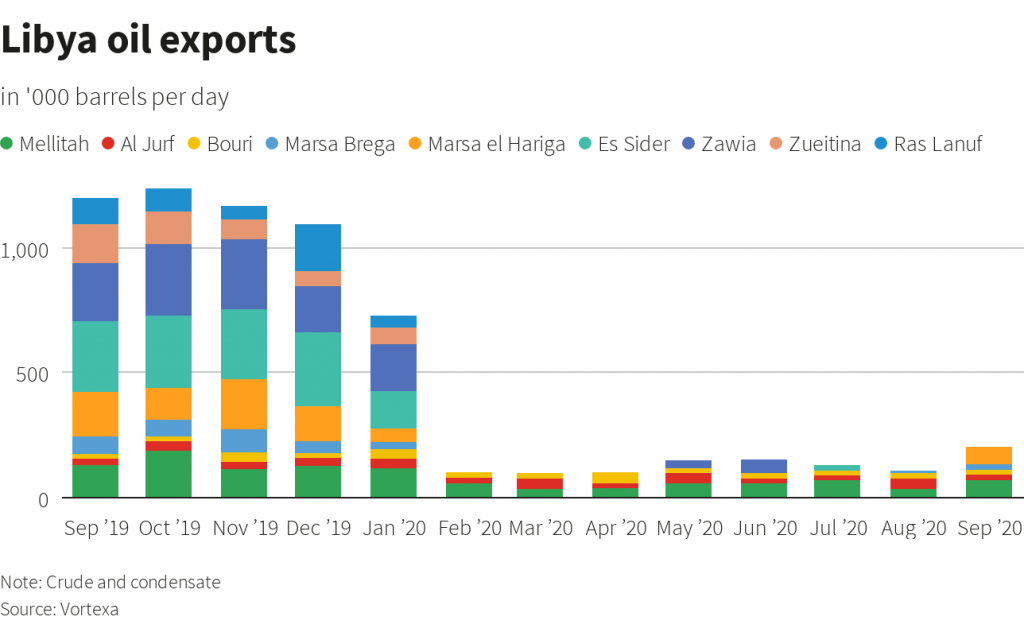

On the supply side, Libya’s National Oil Corp (NOC) said it had lifted force majeure on the El-Feel oilfield.

NOC said on Friday Libyan production would reach 1 million barrels per day (bpd) in four weeks, a quicker ramp-up than many analysts had predicted.

“In an environment where there are renewed worries over the demand outlook, the last thing the market needs right now is additional supply,” said Warren Patterson, ING’s head of commodities strategy.

(Graphic: Libya oil exports )

OPEC+, the group of producers including the Organization of the Petroleum Exporting Countries and Russia, is also set to increase output by 2 million bpd in January 2021 after cutting production by a record amount earlier this year.

“OPEC+ must not be careless and have to address the issue of the extra barrels appearing in the market, otherwise the days of relatively stable oil prices will be numbered,” said oil broker PVM’s Tamas Varga.

Russian President Vladimir Putin indicated last week he may agree to extending OPEC+ oil production reductions.

In the United States, energy companies increased their rig count by five to take the total to 287 in the week to Oct. 23, the most since May, energy services firm Baker Hughes Co BKR.N said. The rig count is an indicator of future supply. [RIG/U]

Still, investors increased their net long positions in U.S. crude futures and options during the week through Oct. 20, the U.S. Commodity Futures Trading Commision said on Friday.