The greenback lost ground amid positive headlines from the US-China trade front

On Tuesday, the US Dollar is slipping back closer to the 93.00 mark and now sits in the red zone near the 93.19 region. The greenback’s weakness gave some support to the EURUSD pair that regained the 1.1800 level and now trying to get a foothold above it.

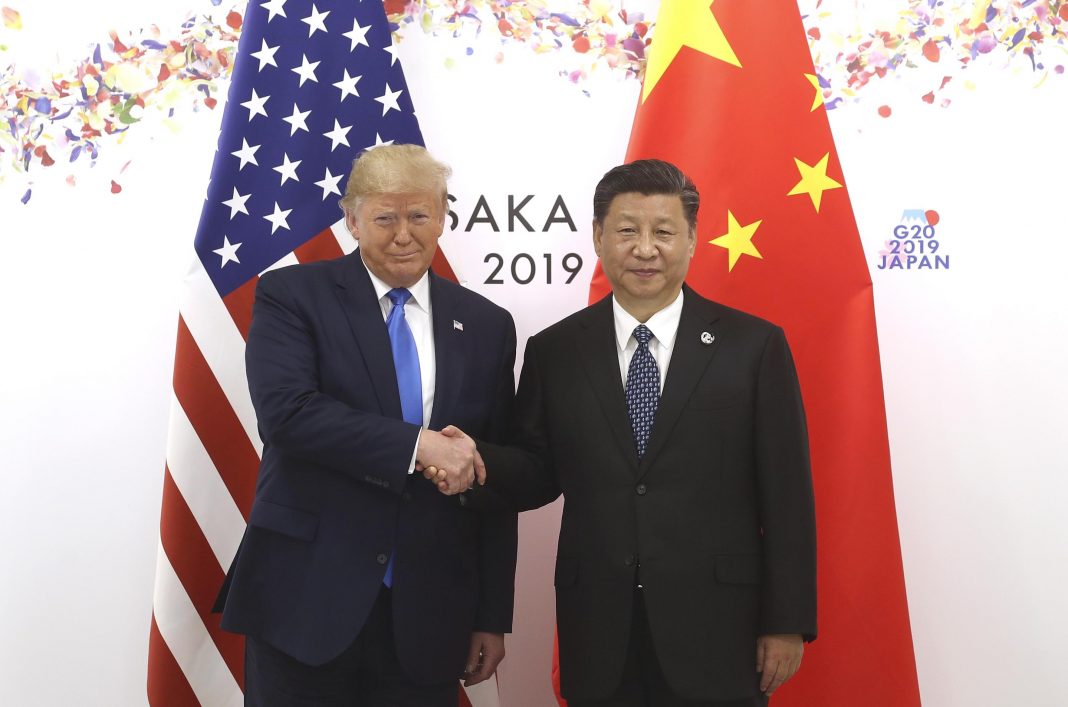

The bullish sentiment around the most popular currency pair was determined by risk-on that returned to the markets mostly due to positive reports on China-US trade relations. Today, during a phone call with Chinese Vice Premier Liu He, the US Trade Representative Robert Lighthizer together with Treasury Secretary Steven Mnuchin discussed the implementation of the Phase 1 of the current trade deal. Both sides said that the talks were ‘constructive’ and saw some progress. They also pledged to take necessary steps to ensure the success of the agreement.

Liu He added that both sides had a constructive discussion over the strengthening of macroeconomic policy coordination and promised to promote further the implementation of the Phase 1 of the trade deal. Those comments inspired markets backing up equities and risk currencies to the detriment of the safe-haven USD.

Meanwhile, the traders’ enthusiasm was further propped up by improving coronavirus statistics from Germany, Florida and Victoria. Although German Robert Koch Institute reported new 1278 cases today, the number was inferior to those seen on Saturday. Florida registered about 2086 new cases.

In the NY hours, the US will release New Home Sales for July, Richmond Fed Manufacturing Index for August, and Consumer Confidence. However, as the statistics are mostly second-rate, traders will take cue from risk sentiment, Sino-American headlines and coronavirus highlights.

From the technical point of view, EURUSD will likely continue its march north with the resistance is seen at 1.1845, 1.1880-90, and 1.1950-65 and the support is marked at 1.1755, 1.1695-10, and 1.1640.