The report from the Commerce Department on Wednesday came as millions of Americans have been thrown out of work, and strengthened economists’ conviction that the economy is in deep recession. States and local governments have issued “stay-at-home” or “shelter-in-place” orders affecting more than 90% of Americans to curb the spread of COVID-19, the respiratory illness caused by the virus, and abruptly stopping the country.

Retail sales plunged 8.7% last month, the biggest decline since the government started tracking the series in 1992. Data for February was revised slightly up to show retail sales slipping 0.4% instead of falling 0.5% as previously reported.

Economists polled by Reuters had forecast retail sales tumbling 8.0% in March. Compared to March last year, retail sales dropped 6.2%.

The Census Bureau said though “many businesses are operating on a limited capacity or have ceased operations completely,” it had “determined estimates in this release meet publication standards.”

Last month’s decrease in retail sales reflected depressed receipts at car dealerships, with light vehicle sales crashing in March. With millions at home and crude oil prices collapsing amid worries of a deep global recession, gasoline prices have dropped, which weighed on sales at service stations in March.

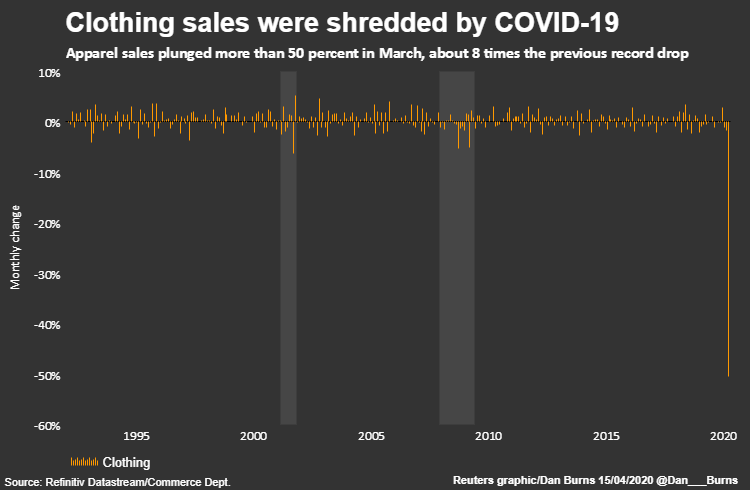

In addition, the closure of non-essential retailers knocked sales at clothing, sporting goods and furniture stores.

There were also steep declines in receipts at restaurants and bars, which stopped in-person service and moved to take-out and delivery service. Though some businesses, including restaurants, have shifted to online sales, the volumes were insufficient to close the gap from social distancing measures.

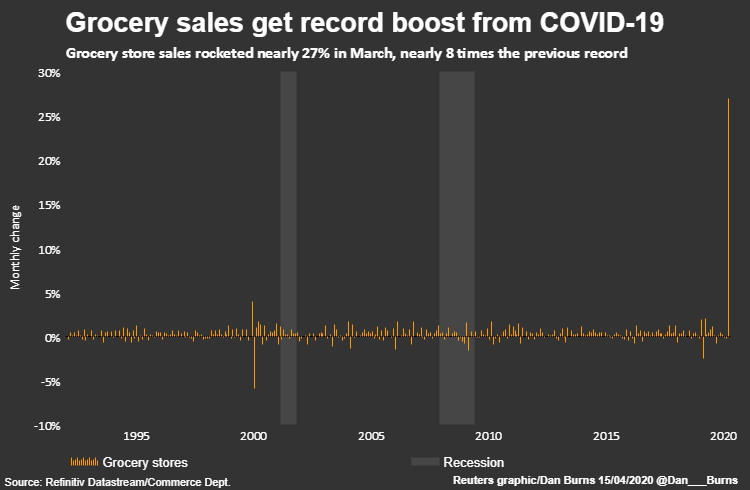

The drag on sales from social restrictions far outweighed a surge in receipts at online retailers like Amazon, and grocery stores and pharmacies as consumers stocked up on household essentials such as food, toilet paper, cleaning supplies and medication.

U.S. stock index futures extended losses on the report. The dollar was trading higher against a basket of currencies. U.S. Treasury prices rose.

A DIFFICULT MONTH

Excluding automobiles, gasoline, building materials and food services, retail sales increased 1.7% in March after a downwardly revised 0.2% drop in February. These so-called core retail sales were previously reported to have been unchanged in February. Core retail sales correspond most closely with the consumer spending component of gross domestic product.

Despite March’s increase in core retail sales, economists are forecasting consumer spending plunging at an annualized rate of at least 5.0% in the first quarter, which would be the weakest performance since the second quarter of 1980.

Consumer spending accounts for more than two-thirds of U.S. economic activity. It grew at a 1.8% pace in the fourth quarter, with the overall economy expanding at a 2.1% rate over that period. Economists see no respite for consumer spending in the second quarter, with estimates as deep as a 41% rate of decline, despite a historic $2.3 trillion fiscal package, which made provisions for cash payments to some families and boosted unemployment benefit checks.

About 16.8 million people have filed claims for unemployment benefits since the week ending March 21.

In March, auto sales tumbled 25.6% after falling 0.5% in February. Receipts at service stations dropped 17.2%. Sales at electronics and appliance stores decreased 15.1%. Sales at building material stores rose 1.3%. Receipts at clothing stores plummeted 50.5% last month, which those at furniture stores collapsed 26.8%.

Spending at sporting goods, hobby, musical instrument and book stores plunged 23.3%. Sales at restaurants and bars dropped 26.5% last month.

But online and mail-order retail sales surged 3.1%. That followed a 0.7% increase in February. Grocery store sales soared 26.9% and receipts at healthcare outlets jumped 4.3%.

Goldman Sachs estimates the economy contracted at a 9.0% annualized rate in the first quarter, which would be the steepest drop in gross domestic product since the first three months of 1958.

Economists believe the economy entered recession in March. The National Bureau of Economic Research, the private research institute regarded as the arbiter of U.S. recessions, does not define a recession as two consecutive quarters of decline in real gross domestic product, as is the rule of thumb in many countries. Instead, it looks for a drop in activity, spread across the economy and lasting more than a few months.